Embarking on your journey into finance often begins with the Securities Industry Essentials (SIE) Exam․ This crucial qualification is designed to kickstart careers in the financial securities industry, particularly for newcomers․ Effective preparation is key to success․

What is the SIE Exam?

The Securities Industry Essentials (SIE) Exam serves as a foundational qualification for individuals aspiring to enter the financial securities industry․ It’s specifically designed to assess general knowledge about the securities market, its structure, regulatory agencies, and prohibited practices within the sector․ This introductory examination is a prerequisite for many specialized FINRA qualification exams, such as the Series 7, but crucially, it can be taken independently by anyone over 18, even those not yet associated with a FINRA member firm․ The SIE exam is meticulously composed of 75 multiple-choice questions, with each item presenting four distinct answer choices, covering a broad spectrum of common securities industry knowledge and general concepts․ While the content might initially seem foreign or daunting for finance newcomers, with diligent and proper preparation, it is widely considered a manageable test․ Successfully passing the SIE demonstrates a fundamental understanding crucial for a career in finance, making it a pivotal first step for many aspiring professionals seeking to kickstart their journey․ Its broad scope ensures candidates grasp essential principles before delving into more complex topics covered by subsequent series exams․

Why Take the SIE Exam?

Taking the SIE Exam is a strategic and highly beneficial move for anyone eyeing a rewarding career in the financial securities industry․ It serves as an essential gateway, allowing individuals to demonstrate a fundamental understanding of market operations, regulatory frameworks, and ethical conduct even before being employed by a FINRA member firm․ For those just starting out or new to finance, passing the SIE is a significant credential that can make your resume stand out to potential employers, greatly enhancing your marketability․ It signals proactive initiative and a readiness to engage with the industry’s core principles․ This early qualification not only opens doors to entry-level positions but also streamlines the path to acquiring more specialized licenses, like the Series 7, by fulfilling a crucial prerequisite․ By securing this foundational certification, candidates are better positioned to pursue various roles within investment banking, brokerage, and asset management firms․ It’s a proactive step that underscores commitment and preparedness, ultimately helping to kickstart and secure a great career in this dynamic and competitive field, especially for those looking to take the exam in 2025 and beyond․

Importance of a Comprehensive Study Guide

For individuals embarking on the Securities Industry Essentials (SIE) Exam, especially those new to the financial sector, a comprehensive study guide is an indispensable tool for success․ The SIE exam, while manageable with proper preparation, can present a significant challenge due to its broad scope and the specialized terminology often foreign to newcomers․ A robust study guide acts as your primary roadmap, meticulously covering all the content you’ll need on your journey toward a career as a financial securities professional․

Such guides, like “SIE Exam 2025/2026 For Dummies” or combined “SIE EXAM SERIES 7 STUDY GUIDE (2-BOOKS-IN-1)” packages, are “highly recommended for anyone looking to take the SIE exam in 2025 and beyond․” They offer structured learning, simplified explanations, practice tests, flashcards, and often additional support or audio versions, ensuring every core concept is thoroughly understood․ They transform the potentially daunting task of cramming vast amounts of information into a manageable and efficient study process․ Without a well-structured guide, navigating the official FINRA curriculum and identifying key areas of focus becomes significantly more challenging, making effective preparation for specific facts and general concepts nearly impossible․ Therefore, investing in a comprehensive study guide is a critical step towards confidently passing the SIE exam on your first attempt․

Understanding the SIE Exam Structure

The SIE exam challenges candidates with its specific format and content․ It consists of 75 multiple-choice questions, each with four answer choices․ Understanding core content areas, general concepts, and insights from the FINRA SIE sample curriculum is paramount for effective preparation․

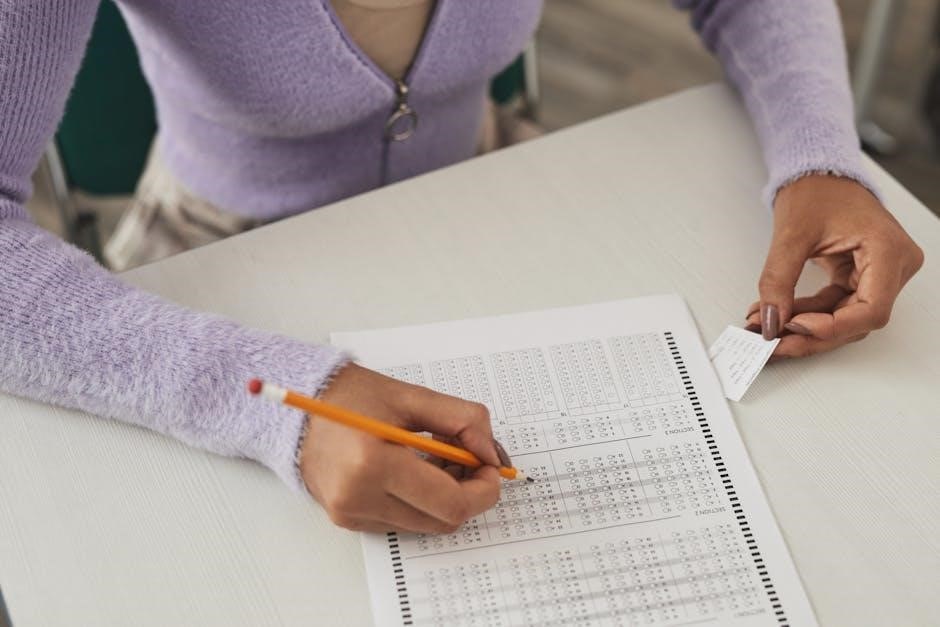

Exam Format: Multiple-Choice Questions

The SIE Exam’s format is a critical aspect for any candidate to master, primarily consisting of 75 multiple-choice items․ Each question presents four distinct answer choices, from which test-takers must select the single best option․ This structure necessitates a strategic approach, where understanding not just the correct answer but also why other options are incorrect can be beneficial․ Study guides for the SIE exam, including comprehensive PDF versions, frequently emphasize the importance of familiarizing oneself with this question style through extensive practice․

Effective SIE exam study guides are indispensable for navigating the test’s multiple-choice architecture․ These guides typically feature numerous sample questions designed to mirror the actual exam’s complexity․ Engaging with these practice questions is invaluable for developing the skill of quickly analyzing scenarios and discerning the most accurate response among related choices․ While practice tests provide excellent examples, performance on them is not an absolute success predictor․ Consistent engagement with multiple-choice drills builds confidence, improves test-taking efficiency under timed conditions, and refines critical thinking skills—key for a successful SIE examination․ A robust study guide offers questions and detailed explanations․

Core Content Areas and General Concepts

The Securities Industry Essentials (SIE) Exam comprehensively assesses a candidate’s grasp of foundational principles crucial for a career in finance․ Much of the content on the SIE outline is based on common securities industry knowledge and general concepts, making it an accessible yet vital starting point for aspiring professionals․ This broad coverage ensures that finance newcomers gain an essential understanding of the market’s operational framework before specializing․ The core content areas encompass a wide array of topics, from basic product knowledge to regulatory structures and ethical considerations, providing a holistic overview․

Candidates are expected to absorb fundamental principles that underpin the financial markets, rather than delve into highly specialized application scenarios․ This emphasis on general concepts means that a solid SIE exam study guide focuses on clearly explaining these universal ideas and their practical implications․ The exam serves as a gateway, providing a baseline understanding of the industry’s landscape․ A well-prepared individual will demonstrate familiarity with key terms, market participants, and the overall mechanics of securities trading, preparing them for more advanced licensing exams․ Mastering these core areas is paramount for initial success in the financial sector․

FINRA SIE Sample Curriculum Insights

The official FINRA SIE sample curriculum offers crucial insights into the precise knowledge areas and general concepts on the exam․ This direct resource is invaluable for comprehensively understanding the full scope and depth of all topics․ Scrutinizing the official curriculum clarifies FINRA’s core requirements, aligning study efforts effectively and efficiently․

A key insight from the FINRA curriculum is its ability to pinpoint subjects less emphasized in commercial study guides․ For example, specific investment structures like PIPES, perhaps not extensively covered in resources like Kaplan textbooks, are often part of the official outline․ This highlights the curriculum’s role in revealing potentially overlooked content․ Leveraging these insights allows for targeted supplementary study, ensuring a robust and complete understanding of the securities industry’s foundational elements․ It moves beyond general knowledge to FINRA’s explicit expectations, empowering test-takers to prepare strategically and avoid surprises on exam day, building confidence․

Top Study Resources for the SIE

Achieving SIE success requires excellent study materials․ Kaplan’s self-paced course and textbook, Achievable’s highly recommended program, and dedicated SIE Exam study guides like “For Dummies” or Series 7 combo books are top choices․ Don’t forget free playlists!

Kaplan Self-Paced Course and Textbook

The Kaplan Self-Paced Course and its textbook are highly recommended resources for SIE Exam preparation․ Many test-takers attribute their first-time success to Kaplan’s comprehensive program․ A significant advantage is the quality of its practice questions, which align closely with the actual exam’s content and style, fostering realistic exam readiness․ Kaplan’s materials are particularly adept at focusing on the “specific facts” crucial for SIE success, rather than abstract application, which is vital given the test’s nature․ Despite the extensive amount of material to cover, the course effectively structures learning, making it manageable․ The Kaplan textbook, typically priced around $60, offers a solid foundation for self-study, with potential discounts improving accessibility․ This blend of structured learning, realistic practice questions, and a clear emphasis on factual recall makes Kaplan a thoroughly leading choice for individuals seeking to confidently pass the Securities Industry Essentials Exam and embark on their finance careers․

Achievable SIE Course Review

For those seeking an alternative yet highly effective study solution for the SIE Exam, the Achievable SIE Course comes highly recommended, especially for individuals new to the finance industry․ Priced affordably, typically between $60-$70, it presents a compelling value proposition for aspiring financial professionals․ Users consistently praise Achievable’s unique ability to simplify complex financial concepts, often described as “explaining it like a baby․” This pedagogical approach is invaluable, ensuring that even newcomers with no prior finance background can grasp the fundamental principles required for the exam with ease and confidence․ Many test-takers who opted for Achievable reported passing the SIE on their very first attempt, underscoring the quality and efficacy of its study material․ Its clear, concise explanations and well-structured content make it an excellent choice for self-study, providing a robust pathway to understanding the core concepts and securing success on this crucial industry examination․

SIE Exam Study Guides: Dummies and Series 7 Combo

Navigating the Securities Industry Essentials (SIE) exam can be made significantly more approachable with specialized study guides․ Among these, the “SIE Exam 2025/2026 For Dummies” stands out, offering comprehensive preparation that includes valuable practice tests and online flashcards․ This resource is tailored to equip candidates with essential knowledge, making complex topics digestible for efficient learning․ Beyond standalone SIE guides, a highly effective strategy for aspiring finance professionals involves utilizing combined study materials, particularly those that integrate SIE and Series 7 content․ The “SIE EXAM SERIES 7 STUDY GUIDE (2-BOOKS-IN-1)” exemplifies this integrated approach, providing clear, concise, and simplified exam preparation․ Such combo guides often come with added benefits like audio versions, one-on-one support, and extensive practice questions—sometimes over 1100—along with case studies and career roadmaps․ This holistic method proves invaluable for individuals planning to take both the SIE and Series 7 exams, streamlining their study efforts and building a robust foundation for their financial career․ Investing in such comprehensive resources ensures thorough understanding and dramatically increases the likelihood of success on both critical examinations․

Utilizing Free Playlists and Resources

For those embarking on their Securities Industry Essentials (SIE) exam preparation, a wealth of free resources can significantly bolster study efforts․ Many online platforms offer valuable content, including dedicated ‘sie exam free playlists’ and ‘some free practice exams’ that are easily accessible․ These free offerings are particularly beneficial for finance newcomers seeking to understand the foundational principles without initial financial commitment․ For instance, YouTube hosts comprehensive series, such as ‘The Complete SIE Exam Series,’ which can serve as an excellent starting point, breaking down complex topics for beginners․ Additionally, various educators provide supplementary video content, often linked as ‘three more great videos for close to test day,’ offering last-minute insights and tips․ It’s important to utilize these ‘free practice exams’ as they are designed to give candidates excellent examples of the types of questions that will appear on the actual exam․ While performance on these sample questions shouldn’t be taken as an absolute prediction, they are crucial for familiarization․ Leveraging these readily available playlists and practice tests provides a cost-effective yet impactful way to solidify understanding and complement any paid study materials, proving highly recommended for anyone taking the SIE exam․

Effective Study Strategies for SIE Success

Achieving success on the SIE Exam requires a strategic approach․ Focus on mastering specific facts and fundamental principles, rather than just application․ Effective preparation, whether you’re a finance newcomer or not, involves structured study and smart resource utilization to pass․

Developing a Study Timeline

Developing a structured study timeline is paramount for navigating the breadth of SIE exam material efficiently․ While some individuals might aim to complete their preparation in as little as two weeks, others may prefer a more extended two-month schedule, particularly if they are new to finance․ The optimal duration largely depends on your existing knowledge of securities industry concepts and the daily time commitment you can realistically dedicate to your studies․

Begin by assessing your availability and setting a target exam date․ Work backward from this date, allocating specific time blocks for each core content area outlined in the FINRA curriculum; Break down large topics into smaller, manageable daily or weekly goals․ Consistency is more valuable than sporadic marathon sessions; even an hour of focused study each day can yield significant and steady progress over time․

Ensure your timeline incorporates dedicated periods for reviewing challenging concepts, revisiting earlier material, and most importantly, taking practice exams․ Regular assessment of your progress helps identify weak areas early, allowing you to adjust your schedule to allocate more time where needed․ A well-designed timeline provides a clear roadmap, reducing stress and ensuring comprehensive coverage of all essential topics for SIE success․ This systematic approach is crucial for solidifying understanding and building confidence before exam day․

Focusing on Specific Facts vs․ Application

A critical insight for preparing for the SIE Exam is understanding its emphasis․ Many test-takers, particularly those new to the financial industry, discover that the exam primarily assesses their knowledge of specific facts and general concepts, rather than complex application scenarios․ One successful Kaplan course user noted, “This test is about knowing specific facts, not necessarily application․” This distinction is crucial for directing your study efforts effectively․

While a foundational understanding of how concepts interrelate is beneficial, the core of the SIE often revolves around recalling definitions, regulatory bodies, types of securities, market structures, and ethical guidelines․ Much of the content on the SIE outline is based on common securities industry knowledge and general concepts․ Therefore, your study plan should prioritize memorization and recognition of these fundamental principles․

Instead of getting bogged down in intricate hypothetical situations, focus on grasping the “what” and “who” behind industry regulations and products․ Utilize flashcards, summary notes, and repetitive drills to solidify your recall of key terminology and rules․ Practice questions are invaluable for reinforcing these facts and familiarizing yourself with how they are presented in a multiple-choice format․ This factual recall approach will be a cornerstone of your success on the SIE exam․

The “Cheat Sheet” Approach to Fundamental Principles

The “cheat sheet” approach is vital for mastering SIE Exam fundamental principles․ With its focus on specific facts, not application, condensing information concisely significantly boosts retention․ One resource confirms a “cheat sheet” offers essential principles for success, whether studying two weeks or two months․ This personalized guide distills complex topics into key takeaways, streamlining your study efforts efficiently․

This method involves actively identifying and summarizing essential definitions, rules, regulations, and market concepts․ Create your own reference tool covering vital SIE curriculum aspects․ Synthesizing information in your own words, not rote copying, profoundly aids deeper understanding and memory consolidation․ This active creation process reinforces knowledge, crucial for effective exam preparation․

Your cheat sheet should encompass critical terminology, regulatory bodies’ functions, investment product types, associated risk factors, and ethical considerations․ Distill these into bullet points or short phrases for rapid review, especially in final days․ Regularly refining this document ensures fundamental principles are at your fingertips, solidifying specific facts critical for passing the SIE successfully;

Preparing for the SIE as a Finance Newcomer

For finance newcomers, the SIE Exam appears foreign, covering common industry knowledge; Success is achievable․ Find study materials simplifying complex topics, explaining them “like a baby,” as noted for Achievable SIE․ This approach is crucial for grasping general concepts and building knowledge from scratch, making initial learning manageable․

Prioritize comprehensive study guides and programs tailored for beginners․ Seek clear, concise, simplified exam preparation․ Resources like the “Complete SIE Exam Series” break down extensive content into digestible segments․ These structured materials are essential for understanding fundamental principles without prior experience, guiding “just starting out․”

Focus on deep comprehension, not just memorization․ A well-structured study plan, combined with beginner-friendly resources, transforms this daunting subject․ It ensures unfamiliar topics quickly become comprehensible, paving the way for a successful first-attempt pass on the SIE Exam․ This is vital for a promising financial securities career․

Mastering Practice Questions and Tests

Practice questions are vital for SIE exam success․ They provide examples mirroring the actual test, helping you familiarize yourself with the format․ Utilize free practice exams and extensive Q&A case studies to strengthen your understanding and identify areas for improvement effectively․

Importance of Practice Exams

Practice exams are an indispensable component of any effective SIE study strategy․ They serve as a critical bridge between theoretical knowledge and actual exam performance, offering a realistic preview of what candidates will encounter on test day․ Many successful test-takers, like those who utilized the Kaplan self-paced course, attest that their practice questions closely mirrored the real exam’s structure and difficulty․ This alignment is crucial for building confidence and reducing test-day anxiety․

Beyond familiarization, practice tests are designed to provide concrete examples of the types of multiple-choice questions that will appear․ While performance on sample questions isn’t an absolute predictor, it offers invaluable insights into your current readiness and highlights areas needing further review․ Utilizing resources that include a substantial number of exam Q&A case studies, perhaps even 1100 of them, allows for extensive exposure to varied question formats and content domains․ Moreover, taking advantage of free practice exams available online can significantly enhance your preparation, ensuring a comprehensive understanding of core concepts and general securities industry knowledge․ This iterative process of taking practice tests, reviewing results, and refining your knowledge base is fundamental to mastering the SIE exam․

Analyzing Practice Test Performance

Analyzing practice test performance is crucial for turning effort into success on the SIE exam․ It’s not enough to simply take tests; a deep dive into your results is essential․ Begin by meticulously identifying the specific content areas where you consistently make errors․ Since the SIE largely focuses on knowing specific facts rather than complex application, pinpointing gaps in factual recall becomes a primary goal․ Review each incorrect answer, not just to learn the correct one, but to thoroughly understand the underlying principle or concept you missed․ Were you confused by particular terminology, or did you misinterpret a general concept of securities industry knowledge? This analytical process helps distinguish between careless mistakes and genuine knowledge deficiencies․ Use your performance data to refine your study plan, strategically allocating more time to challenging topics identified through incorrect answers․ This targeted approach ensures that your study time is spent efficiently, addressing weaknesses and reinforcing strengths for ultimate exam readiness․ Your performance on these sample questions should guide your subsequent study efforts․

Final Preparation and Exam Day Tips

The ultimate prep guide is crucial for final review․ Consolidate all key concepts and general knowledge from your study guide․ Stay calm and well-rested before exam day․ Trust your preparation for a successful SIE outcome․

Ultimate Prep Guide Recommendations

For those aiming to successfully pass the SIE exam and kickstart a career in finance, an ultimate prep guide is indispensable for final preparations․ A highly recommended study guide should offer comprehensive coverage, making it suitable for anyone taking the SIE exam in 2025 and beyond․ Look for resources that are clear, concise, and provide simplified exam preparation, ensuring all core content areas and general concepts are thoroughly addressed․

Consider guides that integrate a “2-books-in-1” approach, potentially combining SIE and Series 7 study material, to offer a holistic career roadmap․ Such comprehensive guides often include valuable features like audio versions, one-on-one support, and an extensive collection of practice questions and case studies—sometimes exceeding 1100 Q&A․ These elements are crucial for solidifying understanding and boosting confidence․ The best guides are designed to help you study all the content you’ll need, making the complex subject matter accessible and manageable for aspiring financial securities professionals․ Choosing a robust, feature-rich prep guide is a pivotal step towards ensuring mastery of the material and achieving success on exam day․

locating the epicenter of an earthquake worksheet pdf answer key

locating the epicenter of an earthquake worksheet pdf answer key  48 laws of power summary pdf

48 laws of power summary pdf  citi program quiz answers pdf

citi program quiz answers pdf  upper back stretches pdf

upper back stretches pdf  esthetician exam study guide pdf

esthetician exam study guide pdf  solomon book of wisdom pdf

solomon book of wisdom pdf  indesit washing machine manual iwdc6125

indesit washing machine manual iwdc6125  norcold refrigerator troubleshooting guide pdf

norcold refrigerator troubleshooting guide pdf  automatic teller operator manual password

automatic teller operator manual password